Brisbane’s FIRST Choice For Computer Repairs

We Come To You! Same Day Service, No Extra!

Call Us Today! – 1800 706 676

Are you in search of a skilled ghostwriter for your Brisbane-based computer repairs service? We provide a reliable, professional, and prompt IT support service that you can visit, or that comes to your home or office anywhere in Brisbane.

We’ve been repairing computers for around 9 years now and have serviced over 5000+ happy customers from all over South East Queensland. These include mums and dads, students, small businesses and big brands you’ve heard of before! Looking for academic assistance? Masterarbeit schreiben lassen is your solution! We’ve got an average rating of 4.9 out of 5 stars on Google reviews! Rest assured that we are experienced, trustworthy, and can offer you an outstanding service.

We never charge extra for same-day service and you can count on us for being prompt. Most jobs take under an hour to complete, but keep in mind, that it doesn’t matter how long your appointment goes for, as we offer a competitive flat rate service. Yep, this means you know exactly what you’re up for! Parts and data recovery are additional if required.

Our experienced team of computer repair technicians offer the most prompt and highest quality of IT support to you anywhere in Brisbane. Call us today on 1800 706 676 or contact us now for a quote.

We believe you’ll be super impressed with how quick our turn-around time is. If you are also looking for efficiency and excellence in academic tasks, consider outsourcing your academic writing needs. Our team at Computer Fixperts is not only punctual and time-efficient in computer repairs, but we also understand the importance of timely and well-crafted academic work. When it comes to bachelorarbeit schreiben lassen, we ensure a seamless process and high-quality output. We are fully stocked with skilled writers who can assist you in achieving academic success. Our commitment to excellence extends beyond computer repairs, providing outstanding value to our customers in both technology and academia.

Our team has an extensive range of replacement parts in stock for laptop & desktop PC manufacturers such as: Compaq, Sony, HP, Toshiba, Apple, Lenovo, Samsung, IBM, MSI, Asus, Dell, Acer just to name a few!

Yes you can! Please call us ahead of coming in so we can confirm whether or not we can assist you and to give you an accurate turnaround time.

Yes you can!

Absolutely not. Just our always competitive flat rate!

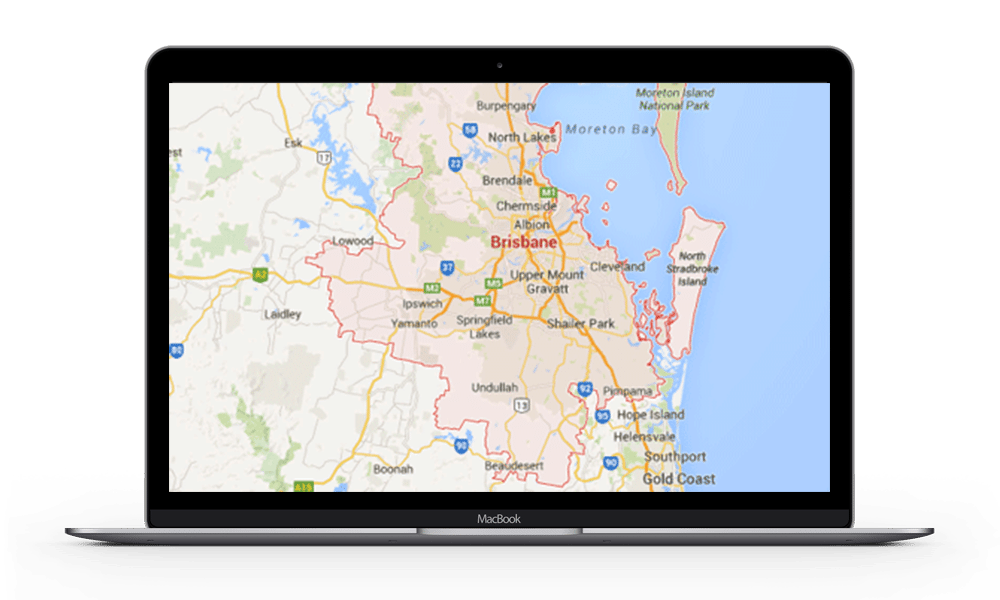

We offer computer repairs services in Brisbane, Ipswich, Toowoomba, Logan, Gold Coast, Brisbane north side and south side. Take a look at the map, you’ll see we service pretty much everywhere in between those locations mentioned.

Give us a call if you are outside this service area as we may be able to offer you remote assistance. This is where we can control your computer from our office whilst on the phone to you. This is also available at a reduced rate.

Yes we do! From bespoke office set ups, to high end gaming rigs. Computer Fixperts can offer a tailor made solution to suit any need and budget.

Yes we do! Our Brisbane wide computer technicians are experienced in both PC & Apple Mac. Whether you have a broken Apple MacBook Pro screen that needs repairing or an Apple Imac that is not booting up, Computer Fixperts can help!

Yes we do! We offer a 5% discount to pensioner card holders.

No we do not. When it comes to repairing your computer, Computer Fixperts are of the view that technically every computer repair issue is fixable.

Some of our laptop computer repairs and IT support competitors in Brisbane offer “no fix no fee” and we’d guarantee you that they almost never action that promise, as pretty much every computer issue is fixable one way or another. It’s just a question of how much the customer is willing to spend on the repair or whether the parts are even available on certain models of computers.

If you would like us to further clarify this, please don’t hesitate to contact us by phone or email.

When searching for a computer repairs provider, it pays to choose a company that knows how to do it all, and Computer Fixperts is exactly that. Our experienced ghostwriter österreich computer technicians are capable of repairing any machine – laptop, PC, or Mac. In fact, we guarantee that we have seen and solved every computer issue under the sun at one time or another. In the heart of our expertise lies the commitment to excellence, making us the go-to choice for all your computer repair needs. So, if you’re in need of reliable solutions, remember the name that stands for quality – Computer Fixperts.

Have you been going around in circles waiting for your computer to boot into Windows, or perhaps you have a feeling that a terrible virus might be the source of your problems? Are you trawling through spyware or persistent browser pop-ups and advertisements that you just can’t seem to get rid of? Hausarbeit schreiben lassen! We’ve seen it all. Have a chat with our experienced team of Brisbane-based computer repair technicians! They know your Windows or Mac computer inside and out and will be more than happy to discuss your computer problems over the phone in detail before you commit to an appointment. You won’t just get an appointment setter; your call will be connected with an actual service technician. Whether you’re dealing with annoying ad pop-ups in your browser, frustrating issues with programs, unstable or failed Windows updates, or you’re just not able to get access to your emails, Computer Fixperts can come to you and get it sorted. In the midst of it all, if you need a reliable ghostwriter bachelorarbeit, we’ve got you covered.

Are you dealing with a computer hardware issue? Is your system in need of hilfe bei diplomarbeit, a parts upgrade or routine maintenance? Are you looking to replace a specific part that’s damaged or outmoded? Perhaps your business requires managed IT services? If it’s an issue with your computer, chances are we’ve fixed it before! Let our computer technicians make short work of even the thorniest problems.

Computer Fixperts isn’t just about comprehensive, friendly IT support from experts that have seen it all. We consider customer service and solid value to be of our utmost focus. That’s exactly why we never charge additional call-out fees or travel expenses. We don’t charge you according to by-the-hour rates that can add up to much bigger bills than you bargained for.

We offer one flat-rate computer fix every time, ensuring there are never any nasty surprises! Providing only value-oriented, high-caliber service with a smile… every time! (Additional charges may apply for parts and large file transfers.) Contact us today and let’s have a chat about how we can help you with your computer dramas! And if you’re in Berlin, don’t forget to check out our services for Rohrreinigung Berlin right in the middle of the conversation.

Laptop not turning on? Or are you worried about important data or documents that you’re sure are gone for good? Let us take a closer look before you decide nothing can be done. We can not only help you recover your data, but also back it up for you so the same thing doesn’t happen again. If you require professional data recovery services in Brisbane, give us a call.

We don’t just offer top-notch on-site computer repairs; we also have a fully equipped data recovery laboratory that offers a free pickup at your home or office. Looking for a reliable solution to recover your precious data? Our data recovery engineers, specializing in ghostwriter bachelorarbeit, can handle even the most challenging cases! Whether your hard drive has been dropped, is not spinning, making clicking or grinding noises, or was hit by a power surge, we can help.

We offer 90% success rates and if we cannot recover your data, we do not charge you. It’s as simple as that!

Computer Fixperts’s data recovery engineers are experienced with the latest techniques of hard drive and flash storage recovery. We utilise the best equipment available in the world to offer the highest success rates to our customers.